How an Ethiopian MFI Has Kept Its Focus on Savings in the Face of Great Challenges

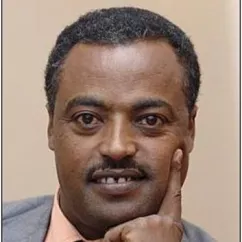

Teshome Dayesso is co-founder and CEO of the Ethiopian microfinance institution Buusaa Gonofaa, which was established in 1999 as a non-bank financial institution focused on women, landless youth and smallholder farmers. He has served on the Board of Directors of AEMFI, the Ethiopian microfinance network and the MAIN Network, the regional African MFI association. Buusaa Gonofaa was a finalist for the European Microfinance Award 2020 for its work with savings. The MFI currently has about 110,000 savers, 85,000 active borrowers, 500 staff and an outstanding loan portfolio of $22 million.

FinDev Gateway: Congratulations on being a finalist for the 2020 European Microfinance Award focused on savings. Can you tell us a bit about Buusaa Gonofaa and your savings journey?

Teshome: From day one, over 20 years ago, Buusaa Gonofaa has offered savings services to our clients. But our approach has changed quite a bit during this time, as we have learned a lot about our customers and what business models work best for us.

At the beginning, we only offered voluntary savings for our borrowers, who are mostly in solidarity groups. Clients could deposit any amount they wanted and withdraw at any time. Deposits and withdrawals thus became very frequent, with clients sometimes making up to four withdrawals in one month. Transaction costs were very high, and after four years had passed, we did not see much growth in the overall savings balance. So, in 2005, we suspended the voluntary savings product and switched to compulsory savings tied to loans.

Then around 2011-2012, we started to focus on savings once again. By that time, we had grown a lot as an organization and had a much more mature understanding of what we could and could not do. In 2012, I put together a product development team with high-profile people and we started doing more conventional product development, from market research to pilots, prototypes, roll-outs, etc. Unfortunately, the counter-based model they developed still did not bring enough benefits for our clients or for the MFI in terms of balance growth.

So in 2015, I took a more unconventional approach and formed five small teams that each worked with a separate branch conducting a "do-and-learn" experimentation for about 100 days to come up with specific solutions. We consolidated the ideas that came out of this experience and in 2016, we rolled out Dejaf Iqub as as a doorstep savings product.

FinDev: Your Dejaf Iqub savings product for informal microentrepreneurs is what attracted the attention of the European Microfinance Award. How does this product work?

Teshome: Dejaf means doorstep in Amharic, and Iqub means rotating savings and credit association (ROSCA), so the idea of this product is to provide the services of a ROSCA with the convenience of doorstep deposits. To begin with, we only target clients who have already been saving in a traditional ROSCA so that we can capitalize on their experience. We want to understand what was working for them and what was not, to be sure we can provide a better experience, and one that is complementary to their ROSCA since most don’t want to leave their groups, where they feel a social attachment.

Our staff first works to identify potential clients, who are mostly informal micro-entrepreneurs based in dense market centers, and then set up a route for weekly deposit pick-ups. Requirements for this product are very minimal. We don’t even require ID, but clients must have a regular cash flow and a fixed place of business where we can find them to receive their deposits. At first, pick-ups are set for once a week, but after 24 weeks, they can increase to a maximum of twice a week. The minimum deposit is set at $2 per pick-up, and the customers commit to a fixed deposit amount for each savings cycle. After 24 weeks, we have some progressively increasing requirements for the customers’ savings balance to grow due to the cost and staff time required, and the amount will be mutually agreed upon based on the customer’s business and cash flow as well as their self-proclaimed savings goal.

Doorstep service is only for deposits; withdrawals must be done at the branch. This set-up helps our customers with their savings discipline, as they generally wish to keep their savings at arms-length to avoid temptation or pressure from others to lend them money.

Face-to-face interaction is one of the key features of Dejaf Iqub, as the presence of our staff at the customers’ doorstep creates a huge pressure on the customers to remember and honor their deposit commitment.

FinDev: This product is a very high-touch model. What does this mean for your MFI, in terms of managing human resources and the time and effort required to serve each customer?

Teshome: Indeed, face-to-face interaction is one of the key features of Dejaf Iqub, as the presence of our staff at the customers’ doorstep creates a huge pressure on the customers to remember and honor their deposit commitment.

It also requires a high level of organization on our part. The biggest challenge is the amount of time and effort required of the staff. For this reason, we can only offer this product in very dense urban marketplaces. In fact, before deciding to operate in a given location, we must first perform a detailed mapping of the area, counting the number of shops and stands, looking at the types of businesses present and estimating their savings capacity, and considering all of the area’s characteristics such as whether it is open air, close to other markets, etc. The staff must then manage their routes very carefully, mapping out and scheduling their pick-up times and places to fit in all of their clients each week.

FinDev: How is Buusaa Gonofaa approaching the movement towards digital channels and operations?

Teshome: Honestly, right now in Ethiopia, we are very far away from digital transformation. It is something that doesn’t even come into my mind. Mobile money penetration is extremely low and there are few to no agents, even in urban centers.

However, we hope that, with the government opening up to allow other telecom operators into the country, we will see change. Over the next three to five years, the digital side of finance will definitely develop with more speed, as can be seen from two major developments. In May 2021, Safaricom received the first ever mobile license issued to a private company. And the government-owned monopoly operator has just launched TeleBirr mobile money, a new service aiming to reach 50 percent penetration within five years.

Many of our clients prefer to leave their savings where they are because it gives them a sense of security during these very uncertain times.

FinDev: How have your clients and their savings been affected by the pandemic over the past year?

Teshome: The COVID-19 pandemic has been devastating. Although our government didn’t really do a lockdown, the economy did shut down significantly during the first six months of the pandemic. Now, however, things are getting back to normal in terms of movement, but at the same time COVID-19 infection rates are picking up. Many of my staff and friends have been infected and I have attended too many burials in the past couple months.

In terms of how it affected our clients and their savings, we saw about a 70 percent decline in savings as we were no longer able to make the doorstep visits to businesses. Savings deposits are now picking up again and, in a few markets, we’ve got about 80 percent of our customers re-connecting with us.

But what is amazing is that, although people stopped making deposits, they also didn’t rush to withdraw their savings. Only in January, did we start to see some people start to withdraw again, cautiously. Many of our clients prefer to leave their savings where they are because it gives them a sense of security during these very uncertain times.

FinDev: Has the Tigray conflict affected your clients and their savings as well, or exacerbated the challenges brought about by the pandemic?

Teshome: It is so unfortunate that we are now walking back down this sad and disastrous road, especially after we had seen some light of hope in our country. The actual conflict is taking place in the north, almost 700km away from our operations, so simply because of the physical distance, it does not really have an effect on our day-to-day life.

However, there are also other localized conflicts and general political insecurity in some remote rural areas where we do have operations, such as the districts of Gimbi and Guliso in the Oromia regional states to the west of Addis Ababa. Our savings and lending operations at three branches in these areas may collapse, which would affect about 10,000 clients.

FinDev: The political uncertainty clearly makes for a challenging operating environment. What other challenges are MFIs in Ethiopia facing these days?

Teshome: Inflation is galloping, at over 25 percent now, and may continue to increase. Farmers are not getting agricultural inputs like seeds and fertilizer because of the government's focus on the election agenda, and if they miss this season it would be devastating for their households and of course for MFIs.

In general, Ethiopia is a country in political transition, which makes things unpredictable and uncertain, on top of an economy which is not in good shape. This will be exacerbated by the global slowdown inflicted by the pandemic. It is very challenging for MFIs to find a growth pocket in such a gloomy socio-economic and political situation.

FinDev: What do you see as key priority areas going forward for Buusaa Gonofaa?

Teshome: Right now, our main focus is on the following projects and tasks:

- Finalize the centralization of our core banking system (currently on a decentralized database). We urgently need to finish this project so we can get data and reports from “one source of truth.”

- Recover clients who deserted due to the pandemic, and/or recruit new clients for both savings and lending operations to maintain a reasonable productivity level and generate a decent profit.

- Reorient staff attitude and motivation which has been demoralized by COVID-induced fear and pressures.

- Recover non-performing loans which were triggered by the pandemic and exacerbated by political unrest and insecurity in some remote rural areas.

- Work on cost containment measures so as to retain staff in the face of deteriorating performance (loss of productivity and efficiency).

Teshome Dayesso , Buusaa Gonofaa , Ethiopia, thank you for the informative and mature experienced news. It is a well-articulated experience and any interested people can get ample lessons form it.

Many thanks!!!

Very interesting news, Congratulations to Teshome Yohannis of Busa Gonfa. very remarkable and Unusual

Dear BG MFI,

It is seemingly motivating experience in order to touch mass based clients. Keep it up moving up-ward to growth of the institution to be the first NGO-Based MFI to be Commercial Bank in Ethiopia.

Thanks for the encouragement, and I hope that scholar would help us clarify whether or not financial inclusion should be seen in terms of moving down-the-market or moving-up-the-market!

Happy to see BG MFI and Teshome highlighted here. Good work!! .... Hope others can learn. Getaneh

Many thanks and sure we too are encouraged!

Thank you Findev for this insightful interview. Kudos?

Leave a comment