How Can Microfinance Contribute to Women's Empowerment?

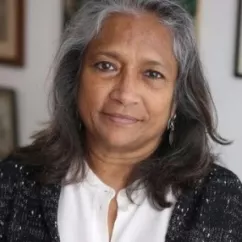

Naila Kabeer is Professor of Gender and Development at the Gender Institute, London School of Economics and Political Science. She possesses an extensive research experience in gender, poverty, social exclusion, labor markets and livelihoods, social protection and citizenship, and was previously Professor of Development Studies at the School of Oriental and African Studies (SOAS) at London University. Naila will be the Key Note Speaker at the Women's Economic Empowerment (WEE) Forum, presenting on Women’s Economic vs. Non-Economic Empowerment: Is it a False Dichotomy?

Gateway: From the very beginnings of microfinance, women's empowerment has been discussed as one of its main social goals. In your experience, have you seen that microfinance initiatives can achieve this goal?

Naila: One of my problems in trying to answer general questions about microfinance is that the providers are such a heterogeneous group and they provide services to very different kinds of women. So I would say that microfinance that offers financial services to women who have some prior experience of entrepreneurship and are not engaged in it for purely subsistence reasons are likely to benefit greatly from microfinance activities, given the barriers they face in accessing formal financial institutions. But for poorer women who are struggling to get their enterprises onto a viable basis, financial services on their own are unlikely to be enough and may even end up plunging them into debt. These women would need financial services as part of a larger package of supportive measures which address their human capital deficits, their unpaid domestic responsibilities and perhaps also lack of self-confidence and fear of taking risks.

Gateway: One of the practical challenges that MFIs often have with an explicit goal of women's empowerment, is how to define and measure this concept, in order to know if progress is being made. Is this a concept that can be measured? How?

Naila: Most organizations work with implicit or explicit theories of how change is likely to happen as a result of their efforts. For MFIs, the theory entails assumptions about how the financial services they provide will translate into empowering impacts in women’s lives. It should be possible to develop indicators of different moments in this process of change and to use them to ascertain what is going on in reality. The indicators could refer to the processes of change as well as presumed outcomes. Indicators of process might measure how financial services are used and who decides. Outcome measures might focus on more immediate outcomes, such as the profitability of women’s businesses or their ability to diversify their livelihoods. Or they might treat profitability and livelihood diversification as intermediate outcomes which leads on to other changes in women’s lives that constitute more direct evidence of empowerment: greater voice and influence in household decision-making, the ability to exit or renegotiate abusive and violent relationships, increased participation in community affairs or local politics. What is important is to have a theory of change that reflects local realities and a vision of empowerment that signifies a real shift in the balance of power, however modest that might be. A major shift is preferable of course!

It is important to bear in mind that empowerment means tackling power relations.

Gateway: What do you think it is important for MFIs to keep in mind when working towards a goal of empowering women?

Naila: I think a number of things are important. One is to bear in mind that women are not a generic category. What may work for women from better-off households or with greater experience in the market may not work for women from less well-off households or those who are struggling to set up businesses for the first time. The constraints they face are different and so the solutions they need will be different. It is also important to bear in mind that empowerment means tackling power relations and that MFIs must embody in their own culture and working practices the respect for their clients and willingness to learn from them that they would presumably like to see as critical elements of women’s empowerment in the wider society.

Gateway: The term "women's economic empowerment" has been used more recently - what does this mean? Are there different types or aspects of women's empowerment?

Naila: I think of economic empowerment as a short hand way of describing processes of change that begin in the economic sphere just as political empowerment refers to processes that begin in the political sphere. But we should not attempt to confine processes of empowerment to particular spheres. Economic empowerment may focus on building women’s opportunities, and their capacity to take advantage of these opportunities but these efforts only really become empowering when they strengthen women’s capacity to take greater control over their own lives and exercise more influence within their communities.

Gateway: Many organizations and recent publications have argued that digital financial services may hold the key to women's financial inclusion. Do you think that the growth of digital finance will help to accelerate women's empowerment?

Naila: Digital finance has a lot of potential to promote financial inclusion: it simplifies access to financial services, cuts out possibly corrupt intermediaries, is be able to reach previously inaccessible populations. But if you believe, as I do, that empowerment has a powerful collective dimension, that women coming together to discuss common problems and find common solutions strengthens their ability to stand up to power, then I worry about whether digital financial services may be implemented in ways that erode these possibilities for collective reflection and action. Again this may be more of a problem in contexts where women find themselves socially isolated than in those where they have wide social networks.