Who Is Innovating in the Arab World?

In its inaugural edition, the Arab Financial Inclusion Innovation Prize (AFIIP) received nearly 100 applications from across the Arab World. A panel of 10 judges representing experts in innovation and financial inclusion evaluated the proposals in a two-stage process. Jenny Ahlzen from the venture capital firm Silicon Badia and one of the 2018 AFIIP judges commented, “It was encouraging to see the diversity of ideas submitted to AFIIP, both from startups and existing MFIs, with several of them having a golden opportunity to really move the needle on financial inclusion in the Arab world.”

Eight finalists were chosen, based on the main AFIIP criteria of innovative potential, impact on the sector, feasibility of implementation, team qualifications, financial viability, and marketability in the Arab World. The finalists presented their innovative solutions to a packed room at the 2018 Sanabel Conference held in Amman, Jordan in early November. Two solutions from Morocco focused on the creation, organization and management of rotative savings and credit communities. Three solutions from MFIs in Jordan focused on more efficiently reaching clients using mobile wallets, and one solution from an MFI in Lebanon focused on streamlining operations using geo-localization. The two remaining solutions focused on online financing and payments.

“As the world becomes more empowered by technology, MFIs will be forced to evolve in a manner that is comfortable to them and their customers yet embraces the opportunity that digital brings,” points out jury member Lowell Campbell, Principal Digital Finance Specialist at the International Finance Corporation (IFC). “Applicants have embodied this ideal and the various submissions have clearly shown how innovation can be used to deliver a strong microfinance sector for the future, if embraced responsibly,” adds Campbell.

So let’s take a look at the eight innovative solutions that made it to the final round this year!

- The AMC Mobile Lender by Ahli Microfinance Company (AMC), Jordan is a mobile application that aims to innovate the core operations of the company to increase the efficiency of access to financial services, enabling and empowering a larger customer base.

- Al Majmoua Mobile Application by Al Majmoua, Lebanon, aims to leverage geographical data and the growth of mobile phones to reach new clients, increase efficiency, and improve client relations. Through the mobile application, clients and prospects will be able to access a wider range of services.

- DINA by Microfund of Women, Jordan, stands for Digital Inclusive Networking Approach and aims to empower all of their clients (Jordanians, refugees, and other foreign-born residents of Jordan) by including them in the financial ecosystem through the expansion of the mobile money agent network.

- Mobile Banking by National Microfinance Bank, Jordan, proposes an integrated mobile banking platform to streamline its operations and provide added value to their clients.

- CIWA by Happy Smala, Morocco, is a mobile app that provides a secured and comprehensive tool to create, organize and manage rotative savings and credit communities.

- Vicyclep by Al Barid Bank, Morocco, is a solution that is halfway between savings and credit, suitable even for the most disadvantaged population, without any risk of over-indebtedness. Vicyclep evokes the traditional practice of savings and credit groups to manage unforeseen events, meet specific needs, prepare for the future, or launch a business that generates jobs and income.

- IFIN by IFAAS and Path Solutions, is a fintech solution that links Islamic financial institutions to retailers, MSMEs, corporations and government bodies to facilitate instant Islamic financing. By connecting all stakeholders through a single platform, IFIN optimizes access to finance, widens outreach, creates more jobs, and increases financial inclusion.

- Mawelni by FOO, is an online micro-loan service that links e-commerce stores and banks with a credit-scoring engine based on alternative data including social media.

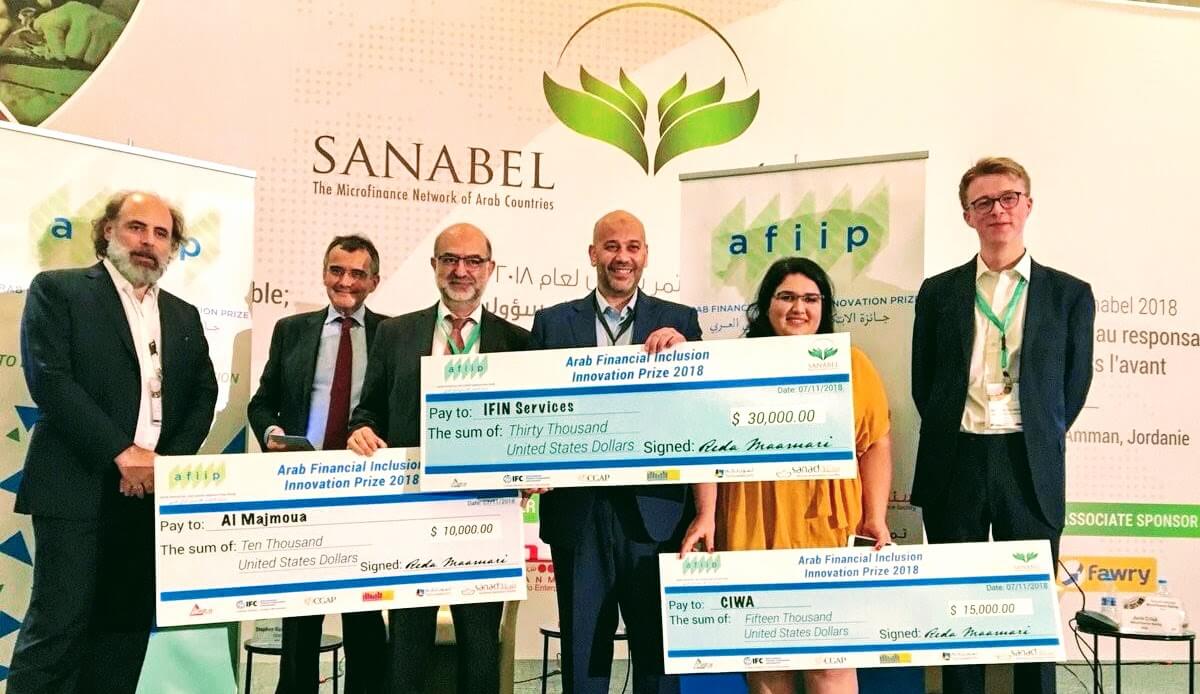

The three winners of the 2018 AFIIP edition were announced at the Sanabel Conference closing ceremony on 7 November 2018. The first prize of $30,000 went to IFIN, the second prize of $15,000 went to CIWA, and the third prize of $10,000 went to Al Majmoua.

Jury member Petar Chavdarov, Associate at SANAD Fund advisor Finance in Motion, commented, “The entrants of this year’s AFIIP Innovation Prize have truly shown that technology has a great role to play in the path towards increasing financial inclusion in the Arab world and more importantly demonstrated that both start-ups and existing MFIs are well-positioned to be the drivers of change.”

In his award speech, Reda Maamari, AFIIP Founder, expressed his pleasure with the results of AFIIP’s inaugural edition and gave a special shout-out to all of the innovative ideas received from Yemen this year. “I hope that the Prize will continue over the coming years to create a synergy between the worlds of microfinance and innovation for greater financial inclusion in the Arab world,” stated Reda. Jury member Nadine Chehade, CGAP Regional Representative for the Arab World, shared that “CGAP will be further supporting innovative solutions to reach the millions unbanked and under-banked in the region in the coming years. To that end, we have just launched a fintech landscaping study that will help us identify emerging opportunities and remaining bottlenecks.”

The Arab Financial Inclusion Innovation Prize (AFIIP) was launched in Spring 2018 with the support of CGAP, Sanad Technical Assistance Facility, International Finance Corporation (IFC), Spectrum Digital Holding, Tamweelcom, Delta Informatics, and in association with Sanabel, Microfinance Network of Arab Countries.